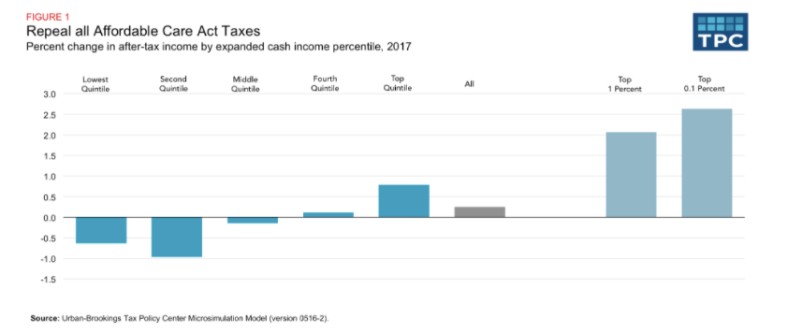

A new analysis by the nonpartisan Tax Policy Center breaks down who would benefit most and least from the tax cuts that would come with Obamacare repeal, assuming Republicans follow the model of their 2015 repeal legislation. It found that those in the top quintile would see their after-tax income rise by 0.8 percent due to the various cuts in the law, while those on the lower end of the earning scale would see their after-tax income decrease, mainly because of the loss of the law’s tax credits to subsidize buying insurance.

As the TPC explains, the multiple moving parts of an Obamacare repeal affect taxpayers in different ways and the variation is wide even within each income group. The ACA tax credits play a major role in determining the losers, but even if they are excluded from consideration, those on the bottom and the middle benefit from the tax cuts far less than those on the top.

For instance, a vast majority (94 percent) of middle-income households (making between $52,000 and $89,000) do see a small tax cut that averages around $110, but three percent of middle-income earners would see a massive tax hike, averaging $6,200, because of the elimination of the tax credits for insurance plans purchased through the individual exchanges.

High-earners see a major cut not just because they don’t stand to lose the subsidies. Two of the taxes that would be eliminated with Obamacare’s repeal are directed at individuals making $200,00 or more. All in all, those in the top 1 percent see a tax cut of $33,000. Those in the top .1 percent will see a cut of $197,000.