Every year the U.S. Energy Information Administration releases an Annual Energy Outlook, which presents an objective examination of energy trends and serves as a starting point for the media and policy community’s analyses of U.S. energy regulations.

The American Petroleum Institute (API) has developed an interactive tool that combs through the data from 2014 and 2015 reports and lets users select hypothetical energy scenarios and visualize their effects in easy-to-interpret charts and graphs — sort of a “Choose Your Own Adventure” for energy policy.

What could happen if retirements of the U.S.’s aging coal-fired power plants accelerated? The retirement of coal-fired power plants in favor of other forms of electrical production is a decade-old trend. Just 10 years ago in the United States, coal generated 2.5 times as much electricity as natural gas, but by 2014 coal generated less than 1.5 times as much. In the following simulation, EIA visualizes what would happen if policies or other factors cause a 3 percent increase in operations and maintenance costs. The result of this scenario would be a reduction in U.S. carbon dioxide (CO2) emissions by 2040 to levels seen in the early 1990s. Additionally, over time, consumers would notice slightly higher electricity prices, but slightly lower gasoline prices.

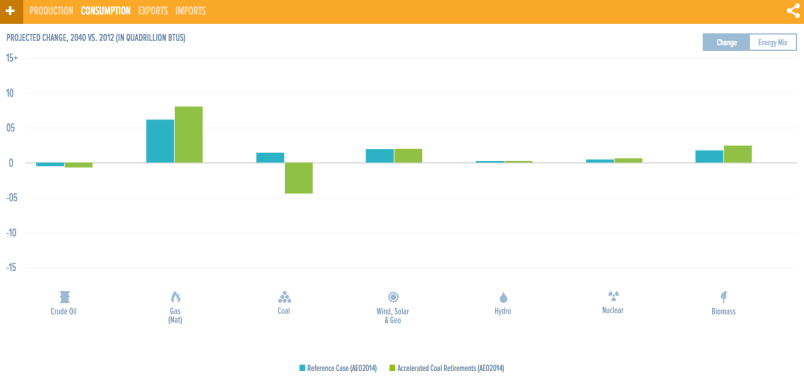

Coal consumption drops, and natural gas consumption goes up

Natural gas is as much as 1.5 times as efficient as coal. Natural gas allows for easier shifts in production to correlate with demand, and gas prices are currently at a more than 10 year low. In sum, natural gas has some strong economic advantages in electricity generation.

Due in part to this transition, the U.S. is already the world’s top consumer of natural gas, and consumption has steadily increased every year as more electric power is generated by natural gas. This chart, created using API’s interactive tool, illustrates how energy consumption will change over the next two decades if the U.S. retires coal plants at an even faster rate. Consumption of natural gas will increase by 30 percent compared with today under an accelerated retirement schedule, while coal consumption will decrease by 25 percent. As the economy grows and energy needs increase, natural gas will continue to play a prominent role in providing energy to fuel that economic growth, and if coal plants are decommissioned early, this role will only increase.

Carbon dioxide emissions would be lower than today

This chart, generated with API’s interactive tool, shows the stark reduction in carbon dioxide (CO2) emissions that an accelerated shift away from coal could create over the next few decades. Under current coal-fired plant retirement plans, emissions levels are projected to continue to increase over the next two decades. According to EIA research, electricity production from coal emits more than twice as much CO2 as from natural gas, and renewables and nuclear power generation emit no CO2. Therefore, EIA forecasts that if coal-fired power plants are retired on an accelerated schedule over the coming decades and replaced with cleaner fuels, in 2040, CO2 emissions in the United States will be lower than today’s levels — at levels consistent with the early 1990s –despite the fact that the economy will be several times bigger in 2040 than it was in the 1990s.

Electricity prices are higher but gasoline is relatively cheaper

This final chart, generated using API’s interactive tool, shows how energy prices will change over the next two decades if coal power plants are retired on an accelerated schedule. Electricity prices would be somewhat higher with the advanced retirements, partially because if natural gas were to replace most of the coal capacity, the additional demand could raise the price of gas. Also, a shift away from the coal infrastructure in the U.S. today could make it more expensive to run the remaining coal plants. Due to all of these factors, future electric power prices overall could be slightly higher compared to a situation in which coal plants are retired as is expected today.

Interestingly, Americans would get a slight price break at the gas pump if factors in the coal power market led to early retirements, despite experiencing somewhat higher electricity prices, according to EIA forecasts. One possible explanation for this is that oil prices and natural gas prices are often — though not always — related. This is because around 50% of natural gas production is a by-product of oil production at the same well. Increased demand for natural gas could also result in extra production of oil and refined gasoline, creating a glut of gasoline and keeping gas prices down at the pump.

You can dig into the EIA data yourself using the tool below.