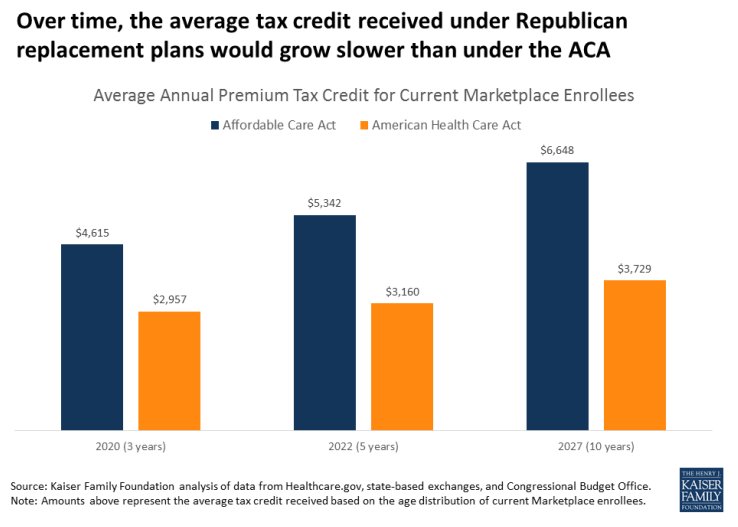

An analysis by the Kaiser Family Foundation of the leading Republican plan to repeal and replace Obamacare shows that the GOP-proposed tax credits will become even more meager when compared to the Affordable Care Act over time.

The analysis predicts that under the GOP bill, titled the American Health Care Act, the tax credits the average individual would receive will be 41 percent lower than what they would had gotten under Obamacare in 2022 and 44 percent lower in 2027. The trend is driven by the metric the Republican proposal uses to increase the credits: inflation plus one percentage point. Health care costs tend to rise faster than inflation, and faster than inflation plus one percentage point.

The Affordable Care Act adjusts its tax credits according to a standard set by average premiums, meaning they will rise alongside the increase of the cost of insurance.

The Kaiser Family Foundation analysis, which was updated Wednesday to reflect the final version of the Republicans’ bill, was based on projected growth rates from the Congressional Budget Office.