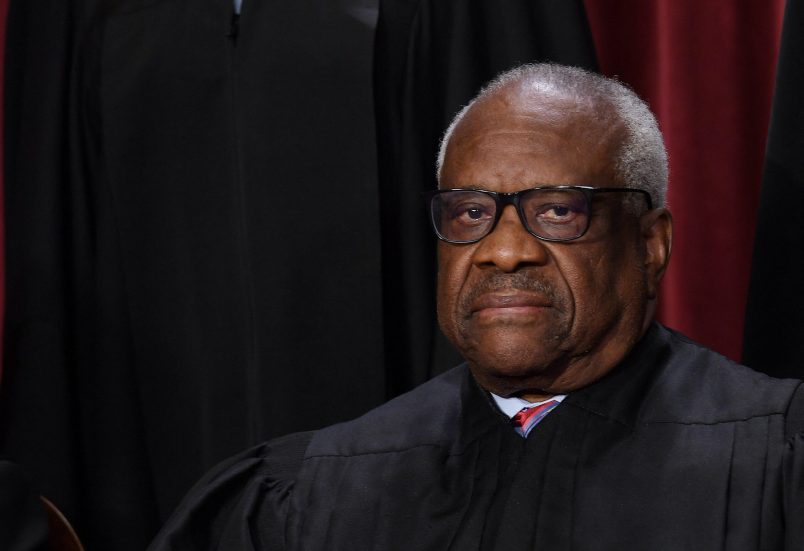

Justice Clarence Thomas’ financial disclosure form was released Thursday, listing three 2022 trips on billionaire Harlan Crow’s private plane and details of Crow’s 2014 purchase of his mother’s house.

The filing — often defensive in tone — calls Crow a “longtime friend of filer and his wife” and insists in a prolonged explanation that Thomas’ past glaring omissions of luxe flights and free vacations were in line with what was required.

Thomas’ pattern of hobnobbing with right-wing donors on their planes and yachts and at their lodges has been extensively reported by ProPublica in a series of articles that were followed up on by other news outlets. Thomas’s filing of his 2022 financial disclosure form had been eagerly anticipated after he obtained an automatic extension beyond the May deadline (the filings are usually made public the following month).

At one point in the new filing, Thomas claims that he had no choice but to hitch rides on Crow’s jet due to the “increased security risk” after a draft of the Dobbs decision overturning Roe v. Wade was leaked in May 2022.

“Because of the increased security risk following the Dobbs opinion leak, the May flights were by private plane for official travel as filer’s security detail recommended noncommercial travel whenever possible,” the filing says.

Thomas also gets his back up when he describes Crow’s purchase of his mother’s house and two vacant lots down the road, first revealed by ProPublica, that he did not report on his financial disclosure form nearly a decade ago.

“In 2014, Mr. Harlan Crow, a longtime friend of filer and his wife, bought all three properties for $133,000, along with other houses/lots on the same street,” the filing reads. “Filer and his wife had put between $50,000 to $75,000 into his mother’s home in capital improvements over the years, and therefore, the transaction amounted to a capital loss.”

The document lists three Crow-sponsored flights (plus lodging on one occasion and plus meals on all three) in 2022. For a private jet ride in February 2022, the document reads that Thomas “flew private on return trip due to unexpected ice storm.”

The document contains some grudging admittance of fault, including past omissions of bank accounts and a life insurance policy. The Crow real estate transaction falls under that heading too.

“Once these properties no longer generated any rental income, filer was advised by Committee staff to remove the two properties from his disclosure forms,” the document says. “However, filer inadvertently failed to realize that the ‘sales transaction’ for the final disposition of the three properties triggered a new reportable transaction in 2014, even though this sale resulted in a capital loss.”

In the disclosure, Thomas also says that — due to updated Judicial Conference guidance — he will list “transportation that substitutes for commercial transportation” on filings going forward.

Revelations of Thomas’ and Justice Samuel Alito’s lavish and often billionaire-funded recreation pushed Congress to start talking about Supreme Court ethics reform earlier this year, though legislative efforts in that arena generally lack Republican support.

Read the disclosure form here: