LAS VEGAS (AP) — More than a third of U.S. states have created school voucher programs that bypass thorny constitutional and political issues by turning them over to nonprofits that rely primarily on businesses to fund them. But the programs are raising questions about transparency and accountability at a time when supporters are urging that they be expanded into a federal program.

Unlike traditional school vouchers, which are directly funded by the states or in the case of Washington, D.C., the federal government, these programs don’t use any public money. Instead, those who contribute to the voucher program get tax credits. Seventeen states now have the so-called tax-credit scholarships.

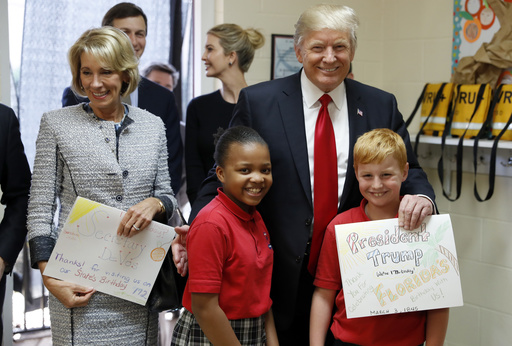

Both President Donald Trump and Education Secretary Betsy DeVos have promoted the scholarships as a way to give parents greater choice in deciding where their children will go to school. Supporters are pushing the administration to launch a federal program extending the tax credit scholarships nationwide.

Asked whether such a proposal might be included as part of a tax overhaul, DeVos said Wednesday in an interview with The Associated Press: “It’s certainly part of our discussion.”

Depending on who you ask, the programs are either another avenue for school choice drawing on the generosity of taxpayers, or a workaround to existing bans on giving public money to religious organizations — in this case schools — with a set-up that’s ripe for abuse. It’s hard to know who’s right, given that the states purposefully limit their fingerprints on their own programs.

For Mayra Puentes of Las Vegas, it was simply a way to get her children a better education. Her son, she said, was struggling in public school, in a state that is ranked at or near the bottom of national lists on the quality of public education.

Puentes said would not have been able to afford the combined $22,000 tuition for her three children at Mountain View Christian Schools.

In Nevada, scholarships are capped annually at about $7,700 per child. They can be used at 86 private schools, not all of them accredited.

How the program works:

Nonprofits solicit contributions from businesses and others. The organizations distribute the funds to families that apply. They keep 5 percent to 10 percent of the donations for administrative costs.

Contributors can deduct the amount they gave, sometimes dollar-for-dollar, from their state tax bill.

Most states designate the vouchers programs for low-income families.

“They are this weird blend of tax policy and education policy, and in a lot of ways, they are treated more like tax policy,” said Josh Cunningham of the National Conference of State Legislatures, which tracks the programs.

Nevada lawmakers secured a $20 million boost for the scholarships this year, after Republicans suffered a crushing blow when they couldn’t get money for their embattled Education Savings Accounts, a different type of school choice program.

Assemblyman Paul Anderson, a Republican, said government transparency laws do not and should not apply to the tax-credit scholarships because the tax component is confidential by nature, and the private sector is handling the rest. He said it was no different than a church asking its parishioners for donations — even though the state created the voucher program.

Supporters have on their side the U.S. Supreme Court, which has ruled that the contributed money is private funds because the cash is never touched by the state.

But government transparency watchdogs have warned that the set-up can be problematic, with abuses well-documented. In Alabama and Georgia, for example, groups advertised the programs as money-making for contributors. In Arizona, a lawmaker makes six figures annually by running a scholarship group in the same system that he has supported.

Critics say under certain circumstances, wealthy contributors could even make a profit by claiming the “charitable” deduction multiple times over at the state and federal levels.

The AAA Scholarship Foundation Inc. which runs programs in Nevada and five other states, says it doesn’t give tax advice but has, when asked, shared an IRS memo on the matter.

The Institute on Taxation and Economic Policy say loopholes in the tax code would allow contributors to both eliminate their state tax bill and also get a charitable deduction off their federal taxes, and in some cases, also their state taxes. Carl Davis, the Washington-based think tank’s research director, likened the system to a money-laundering tax scheme because the contributions are officially considered donations — even if the scholarship money goes to for-profit schools.

“That’s not charity. That’s just helping facilitate the movement of funds. These so-called donors are really like middlemen,” Davis said. “They’re not making a financial sacrifice.”

The research firm estimates that states give away $1 billion annually in tax credits for these voucher programs. Aside from closing the loophole, states could also rein it in by requiring contributors to show their federal tax return to prove that they aren’t “double-dipping,” Davis said.

EdChoice, a leading school choice advocacy group, defends the tax-credit program, saying it’s accountable to parents who can choose to take their kids elsewhere if they don’t like a school, even if there are, like in all government programs, some cases of abuse.

Acknowledging that there are things to address, EdChoice’s policy director Jason Bedrick says his team has advised scholarship groups not to mischaracterize the system as a “get rich quick” scheme.

But he’s not apologetic about the tax loophole, saying it’s no different compared to tax credits for other charitable causes that in some states, though very rarely, is also a dollar-for-dollar contribution. And if there is tax code reform to address double-dipping, it should apply uniformly to all donor tax credits — not just for a highly political issue like vouchers.

“Some people might not like that, but they’re acting within the letter of the law. I see no problem with that,” Bedrick said. “Nobody’s going to go to jail for this.”