Cameron Joseph contributed reporting

President Donald Trump’s Twitter demand Wednesday morning that a repeal of Obamacare’s individual mandate be inserted in the Republican tax bill came out of the blue—and it’s going over like a lead balloon on Capitol Hill.

The lead author of the tax plan, set to be unveiled on Thursday, as well as moderate Republicans whose votes are crucial for its passage and conservative allies of the President, say they’re opposed to adding in the mandate repeal this late in the game, and warn that doing so could put the entire bill in jeopardy.

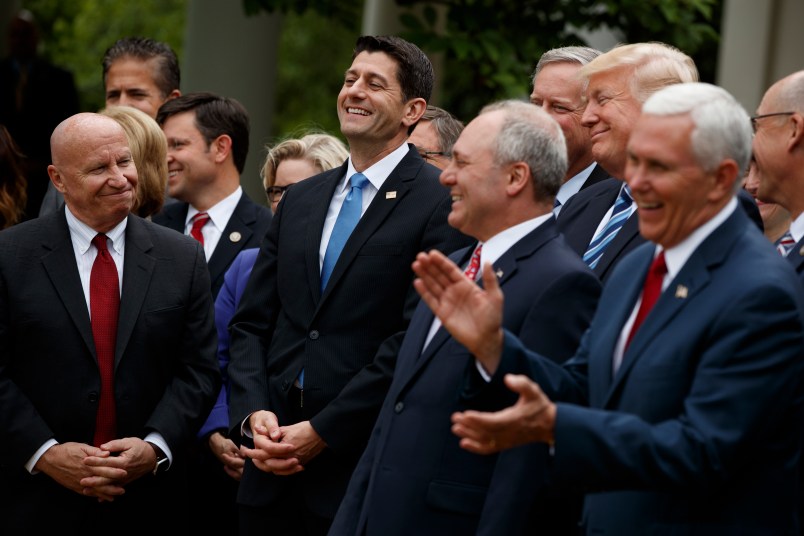

“What I don’t want to do is to add things that could again kill tax reform like health care died over there,” House Ways and Means Chairman Rep. Kevin Brady (R-TX), the principal negotiator of the bill, told conservative radio host Hugh Hewitt. “I want to see that individual mandate repealed. I just haven’t seen, no one has seen, 50 votes in the Senate to do it.”

Rank-and-file Republican lawmakers, their wounds still fresh from a string of failed health care votes earlier this year, echoed Brady in interviews Wednesday, waving away Trump’s proposal.

“I do not believe you’re going to see any health care reform in this bill at the eleventh hour, 59th minute, 58 second mark,” Rep. Chris Collins (R-NY), a close ally of Trump’s, said flatly. “There’s no time to deal with it, that I see. I believe we’re too far along.”

Speaking in the ornate Speaker’s Lobby just off the House floor, Collins played down Trump’s call for the provision’s inclusion as a mere expression of his frustration with the continued existence of Obamacare.

“I don’t blame him,” Collins told TPM. “There are things we’d all like to see gotten rid of. I’d like to see the repeal of the medical device tax myself. But that’s not going to make it in there either.”

Rep. Tom MacArthur (R-NJ), the former leader of the moderate Republican Tuesday Group, agreed.

“I don’t want to make this bill more complicated than it already is,” he said.

Even White House Press Secretary Sarah Huckabee Sanders undercut Trump’s demand from the podium on Wednesday, telling reporters that while the administration wants to “repeal and replace Obamacare,” she “thinks it’s probably more likely that we do something like that in the spring.” In Tuesday’s briefing, she was even more dismissive, saying of the individual mandate repeal: “I don’t believe it has to be part of tax reform.”

Trump endorsed the policy in a tweet Wednesday morning after a lobbying effort by Sen. Tom Cotton (R-AR), who has made repealing the individual mandate through tax reform a personal crusade. Both argued, correctly, that doing so would save the government hundreds of billions of dollars over 10 years. But they neglected to mention that the savings are due to millions fewer people having health insurance if the mandate were repealed.

In a study last year, the non-partisan Congressional Budget Office found that repealing the individual mandate would result in the following: “About 2 million fewer people would have employment-based coverage, about 6 million fewer people would obtain nongroup policies (insurance people can purchase directly either in the marketplaces or from insurers outside the marketplaces), and about 7 million fewer people would have coverage under Medicaid. All together, the agencies estimate, 43 million people would be uninsured in 2026.”

As younger and healthier Americans drop their health insurance voluntarily due to the mandate’s repeal, the CBO found, premium would skyrocket for everyone remaining in the market, making coverage unaffordable for older and sicker patients and leading to a “death spiral.”

Still, members of the House’s far-right Freedom Caucus and their ideological counterparts in the Senate say they plan to push for the policy, and say if it’s not included in the bill itself, they’ll attempt to insert it as an amendment.

“If we put it in tax reform, you’ve got a pay-for right there, a very credible pay-for that’s consistent with what most Republicans want,” Rep. Mark Meadows (R-NC) argued Wednesday. “Including it in tax reform seems like a very prudent thing to do.”