A Chinese billionaire closely tied to Stephen K. Bannon was arrested on Wednesday morning on federal fraud and money laundering charges, Manhattan federal prosecutors said.

Prosecutors hit exiled magnate Guo Wengui, also known as Miles Kwok, Ho Wan Kwok, and other aliases, with ten criminal counts relating to an alleged fraud scheme worth $1 billion.

Per an indictment dated March 6 but unsealed on Wednesday, Guo and an associate named William Je created a “series of complex fraudulent and fictitious businesses” through which they purportedly defrauded thousands of investors.

News reports on Wednesday showed a fire burning at the Sherry-Netherland, the Manhattan hotel where Guo had been living and was arrested. ABC News reported that FBI agents were still inside the apartment when the fire broke out and were forced to evacuate.

The FBI is reportedly investigating whether the fire is connected to Guo’s arrest.

Guo moved to the U.S. in 2015, and presented himself as a billionaire fleeing persecution from the Chinese Communist Party.

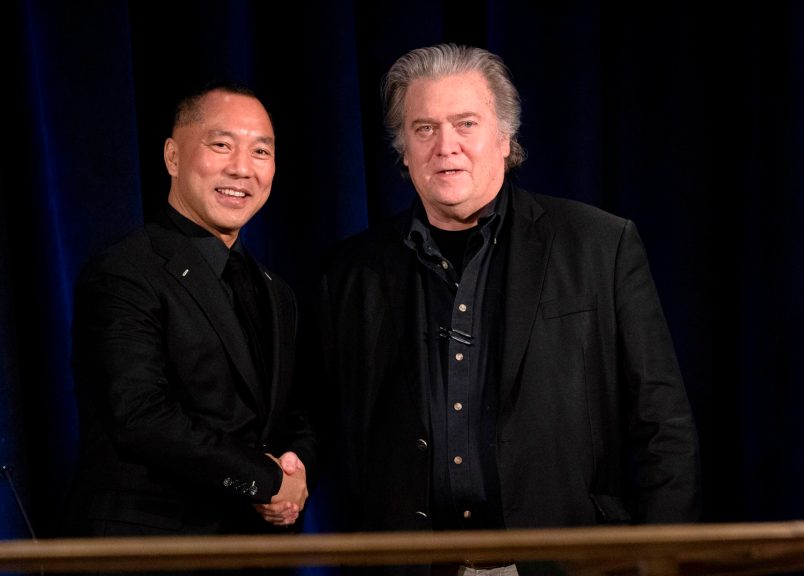

After Trump came into power, Guo cultivated a close relationship with Bannon, then recently departed from The Donald’s administration. Bannon, Axios reported, signed a $1 million contract with a Guo firm for “consulting services” in 2019.

Bannon also served on the board of a non-profit that Guo formed called the Rule of Law Society, before departing that role in 2021. When federal agents nabbed Bannon in 2020 on allegations of fraud related to the We Build the Wall fundraiser, he was located on Guo’s yacht.

Bannon was not named and did not appear to be referenced in the indictment unsealed Wednesday.

Guo has denied allegations of wrongdoing related to his business activities in the past. In a post on Gettr Wednesday morning, he apologized to fans that he would not be able to do a live broadcast that day. Per Google Translate, he said FBI agents had searched his house starting early in the morning, and that he had been “taken to court for interrogation.”

Federal prosecutors say that non-profits and companies formed by Guo served his alleged financial conspiracy.

The Rule of Law Society, for example, is accused of serving as a means for Guo to “amass followers who were aligned with his purported campaign against the Chinese Communist Party and who were also inclined to believe [Guo]’s statements regarding investment and money-making opportunities.”

“In truth and in fact, and as [Guo] well knew, he and others provided false and materially misleading information to promote these ‘opportunities’ and to defraud [Guo]’s followers and other victims,” the indictment reads.

Prosecutors accuse Guo of using his fame to lure people into investments, including a membership organization divided into “farms” and a purported crypto “ecosystem” called the “Himalaya Exchange.”

With the money, prosecutors say, Guo allegedly obtained a Porsche, a Rolls Royce, a “superyacht,” a $62,000 smart TV, and a New Jersey mansion, among other luxury purchases.

Bannon worked with Guo in part to create a movement for the “New Federal State of China,” an unborn government-in-exile that would, Bannon and Guo said, eventually replace the CCP. A June 2021 event for the project saw Michael Flynn speak. Rudy Giuliani and Mike Lindell were in attendance.

The SEC separately charged Guo, with the agency calling him a “serial fraudster, who raised more than $850 million by promising investors outsized returns on purported crypto, technology and luxury good investment opportunities.”

Read the indictment here: