SAN FRANCISCO (AP) — Billionaire Warren Buffett has established his credentials as a savvy money manager, but Internet trailblazer Marc Andreessen doubts the stock market sage knows much about financial innovations such as the virtual currency bitcoin.

The wild swings in bitcoin’s value during recent months prompted Buffett, 83, to dismiss the currency as a “mirage” during an interview on the financial news channel CNBC earlier this month.

The putdown irked Andreessen, who is now running a Silicon Valley venture capital firm that has invested about $50 million in startups betting that bitcoin will continue to catch on as an alternative payment system around the world.

“The historical track record of old white men who don’t understand technology crapping on new technology is, I think, 100 percent,” Andreessen quipped to the delight of bitcoin enthusiasts attending a conference Tuesday in San Francisco.

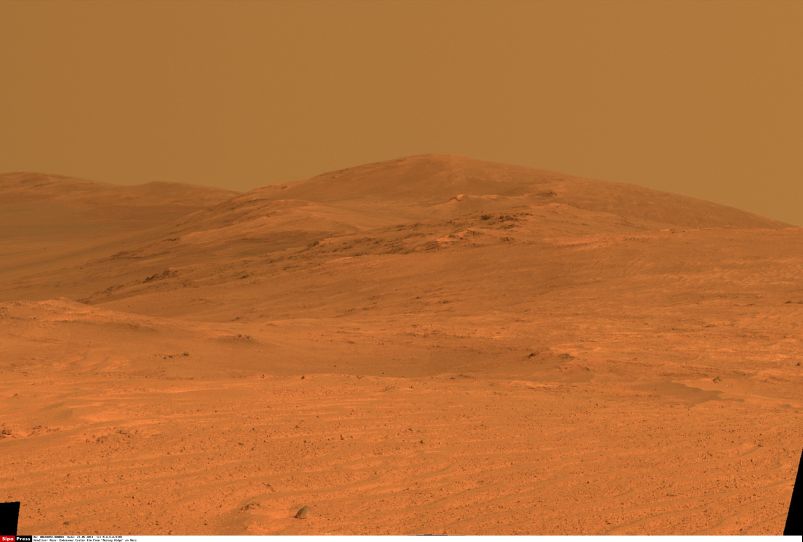

Warren Buffett and Astrid M. Buffett at the White House in 2012

Buffett, who has built a $64 billion fortune through his control of Berkshire Hathaway Inc., didn’t respond to requests for comment.

Andreessen, 42, is also white. He is revered in technology circles for co-founding Netscape Communications, which helped popularize and commercialize the Internet during the mid-1990s with a then-revolutionary Web browser. His venture capital firm, Andreessen Horowitz, has emerged as one of the country’s most successful tech investors. An early investment in virtual reality headset maker Oculus paid off Tuesday with FacebookInc.’s announcement that it is buying the startup for $2 billion.

Buffett has shied away from technology investments because he believes it’s too difficult to identify which companies will consistently generate reliable returns. Berkshire Hathaway generally puts its money into more staid industries, such as railroads, financial services, oil, food and retailing, though it does own a major stake in IBM Corp., one of the world’s largest and oldest technology companies.

Andreessen evidently didn’t think his criticism of Buffett was too outlandish. After his onstage appearance at the bitcoin conference, Andreessen noted on his Twitter account that Buffett’s technological naiveté has been well-known for decades. Andreessen then pointed out that he avoids expressing his opinions about things he doesn’t understand.

“I myself know nothing about railroads,” Andreessen tweeted. “Correspondingly have no view on them.”

Andreessen’s skewering of Buffett comes amid an intensifying debate about bitcoin’s long-term prospects.

The concept, hatched five years ago by a mysterious figure or group identified as Satoshi Nakamoto, has been brushed off as a fleeting fad by many other critics besides Buffett. Supporters such as Andreessen, however, are convinced bitcoin is destined to challenge government-backed currencies as the preferred way to buy things, especially across international borders.

The conflicting viewpoints about bitcoin’s fate have contributed to the currency’s dramatic fluctuations. During the past year, one bitcoin has traded for under $100 and more than $1,100. Recently, it has been trading around $600.

At that price, a bitcoin is still worth about eight times more than it was a year ago. That prompted Andreessen Horowitz general partner Balaji Srinivasan to tell the bitcoin conference that the currency has generate better returns than Berkshire Hathaway’s Class A stock, which has climbed by about 21 percent during the past year.

Buffett, though, has said he doesn’t view bitcoin as a currency, and the Internal Revenue Service is siding with him for now. In a Tuesday ruling, the IRS said that for U.S. tax purposes, virtual currencies will be treated as a piece of property instead of legal tender.

Copyright 2014 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Ed. note: Marc Andreessen is a minority investor in TPM Media, LLC, which publishes TalkingPointsMemo.com