This article first appeared at ProPublica. It is reprinted here as part of TPM Cafe, TPM’s home for opinion and news analysis.

Nikki Spretnak loved being an IRS agent. Being able to examine the books of different businesses gave her an intimate view of the economy. But over the years, she became more and more conscious of a chasm between the business owners she was auditing and herself. It wasn’t so much that they were rich and she, a revenue agent in the IRS office in Columbus, Ohio, was not. It was that, when it came to taxes, they lived a privileged existence, one that she, a mere W-2 recipient, did not share.

Over the past year, along with a team of my colleagues at ProPublica, I’ve spent countless hours scrutinizing the tax information of thousands of the wealthiest Americans. Like Spretnak, I’ve seen behind the veil and witnessed the same chasm. Doing my own taxes in the past was never a thrill, but only this spring did I fully realize what a colorless and confined tax world I inhabit.

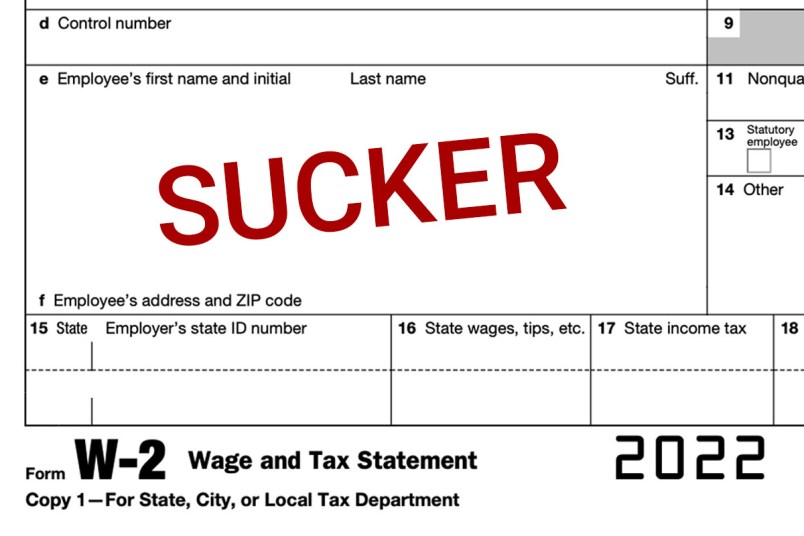

For me, and for most people, filing taxes is little more than data entry. I hold in my hand my W-2 form from my employer and dutifully peck in my wages. Next come the 1099 forms that list my earnings from dividends or interest, and again my finger gets to work. The IRS has a copy of these forms, too, of course, making this drudgery somewhat pointless. By the end of it, there, in black and white, is my income.

The financial reality of the ultrawealthy is not so easily defined. For one, wages make up only a small part of their earnings. And they have broad latitude in how they account for their businesses and investments. Their incomes aren’t defined by a tax form. Instead, they represent the triumph of careful planning by skilled professionals who strive to deliver the most-advantageous-yet-still-plausible answers to their clients. For them, a tax return is an opening bid to the IRS. It’s a kind of theory.

In that tax world, nearly anything is possible. Stephen Ross is one of the world’s most successful real estate developers, a billionaire many times over, the owner of the Miami Dolphins. Ross, a former tax lawyer, once praised tax law as a particularly “creative” endeavor, and he is a master of the craft. His tax returns showed a total of $1.5 billion in earnings from 2008 to 2017, but he didn’t pay a dime in federal income taxes during that time. How? By mining a mountain of losses he claimed for tax purposes, as ProPublica reported. Look at Ross’s “income” for any of those years, and you’ll see numbers as low as negative $447 million. (He told ProPublica he abides by the tax laws.)

Texas billionaire Kelcy Warren owns a massively profitable natural gas pipeline company. But in an orgy of cake eating and having, he’s able to receive hundreds of millions of dollars from his company tax-free while reporting vast losses to the IRS thanks to energy-industry and other tax breaks, his records showed. (Warren did not respond to our questions.)

Based on those reported “incomes,” both Ross and Warren received COVID stimulus checks in 2020. We counted at least 16 other billionaires (along with hundreds of other ultrawealthy people, including hedge fund managers and former CEOs) among the stimulus check recipients. This is just how our system works. It’s why, in 2011, Jeff Bezos, then worth $18 billion, qualified for $4,000 in refundable child tax credits. (Bezos didn’t respond to our questions.)

A recent study by the Brookings Institution set out with a simple aim: to compare what owners of privately held businesses say they earn with the income that appears on the owners’ tax returns. The findings were stark: “More than half of economic income generated by closely held businesses does not appear on tax returns and that ratio has declined significantly over the past 25 years.”

That doesn’t mean business owners are illegally hiding income from the IRS, though it’s certainly a possible contributor. There are plenty of ways to make income vanish legally. Tax perks like depreciation allow owners to create tax losses even as they expand their businesses, and real estate developers like Ross can claim losses even on appreciating properties. “Losses” from one business can also be used to wipe out income from another. Sometimes spilling red ink can be lots of fun: For billionaires, owning sports teams and thoroughbred racehorses are exciting loss-makers.

Congress larded the tax code with these sorts of provisions on the logic that what’s good for businesses is good for the economy. Often, the evidence for this broader effect is thin or nonexistent, but you can be sure all this is great for business owners. The Brookings study found that households worth $10 million or more benefited the most from being able to make income disappear.

This isn’t just about a divide between rich and poor. Take two people, each earning $1 million, one through salary, the other through their business. Though they may live in the same neighborhood and send their kids to the same private school, they do not share the same tax world.

Under the current system, said John Sabelhaus, a former Federal Reserve economist and one of the study’s authors, “if you’re getting a W-2, you’re a sucker.”

This basic divide is also apparent in how tax laws are enforced. To the IRS, the average worker is an open book, since all their income is disclosed on those W-2s and 1099s. Should they enter an errant number on their tax return, a computer at the agency can easily catch it.

But that’s generally not true for private businesses. Such companies are often tangles of interrelated partnerships that, like densely grown forest, can be hard to penetrate. Auditing businesses like these “certainly is a test of endurance,” said Spretnak, the former IRS agent.

If she managed to solve the puzzle of how income flowed from one entity to another, she moved on to a stiffer challenge. It didn’t matter if what she saw made her jaw drop. She had to prove that the business’s tax geniuses had exceeded even what the generous tax laws allowed them to do. Often, she found, they had. Making her findings stick against a determined and well-funded opponent was her final hurdle.

By the time Spretnak retired in 2018, the IRS had gone from merely budget-constrained to budget-starved. Thousands of skilled auditors like her have left, not to be replaced. Audits of the wealthy have plummeted. Business owners have still more reason to be bold.

On the other side of the chasm from the W-2er, there’s still another tax world, one that’s even more foreign than that of business income. It’s the paradise of unrealized gains, a place particularly enjoyed by the major shareholders of public companies.

If your company’s stock shoots up and you grow $1 billion richer, that increase in wealth is real. Banks will gladly lend to you with such ample collateral, and magazines will put you on their covers. But if you simply avoid selling your appreciated assets (that is, realizing your gains), you haven’t generated income and therefore owe no tax.

Economists have long argued that to exclude such unrealized gains from the definition of income is to draw an arbitrary line. The Supreme Court, as far back as 1940, agreed, calling the general rule of not taxing unrealized gains an “administrative convenience.”

From 2014 to 2018, the 25 wealthiest Americans grew about $400 billion richer, according to Forbes. To an economist, this was income, but under tax law, it was mere vapor, irrelevant. And so this group, including the likes of Bezos, Elon Musk and Warren Buffett, paid federal income taxes of about 3.4% on the $400 billion, ProPublica reported. We called this the group’s “True Tax Rate.”

Recently, the Biden administration took a major step toward the “True Tax Rate” way of seeing things. It proposed a Billionaire Minimum Income Tax for the ultrawealthy that would treat unrealized gains as income and tax them at 20%.

To say that the idea’s fate in the Senate is uncertain would probably be overstating its chances. It is nevertheless a landmark proposal. Instead of the usual talk of raising income tax rates on the rich, the Biden proposal advocates a fundamental rethinking.

In the tax system we have, billionaires who’d really rather not pay income taxes can usually find a way not to. They can bank their accumulating gains tax-free and deploy tax losses to wipe out whatever taxable income they might have. They can even look forward to a few thousand dollars here and there from the government to help them raise their kids or get through a national emergency.

You can think of efforts to change this system as a battle between the rich and everybody else. And sure, it is. But it’s also an effort to pull those other tax worlds down to the terra firma of the wage earner, to make it so a W-2 isn’t the mark of a sucker.